Try our newest merchandise

Introduction: US commerce with China weakening

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world economic system.

Donald Trump’s commerce battle is weakening the US economic system and inflicting a plunge in commerce with China, economists and logistics corporations are warning.

Almost 4 week’s after Trump’s ‘Liberation Day’ announcement of upper tariffs triggered a commerce battle with Beijing, proof is mounting that companies and shoppers are reducing again.

Torsten Sløk, chief government at asset supervisor Apollo International Administration, explains:

For corporations, new orders are falling, capex plans are declining, inventories have been rising earlier than tariffs took impact, and corporations are revising down earnings expectations.

For households, shopper confidence is at record-low ranges, shoppers have been front-loading purchases earlier than tariffs started, and tourism is slowing, specifically worldwide journey.

Sløk has pulled collectively a chartbook highlighting the harm to firm earnings…

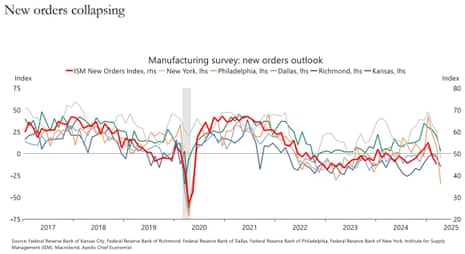

…on new orders…

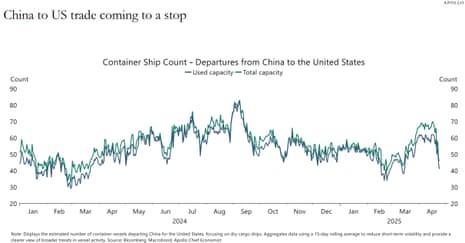

…and notably on commerce with China.

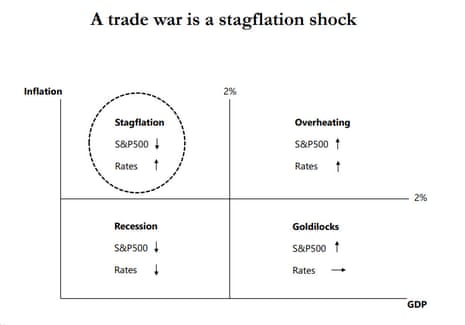

A commerce battle is a “stagflation shock”, Sløk fears.

He explains that it usually takes between 20 and 40 days for a sea container to journey from China to the US. That implies that the slowdown in container departures from China to the US which began in early April will likely be felt at US ports in early and mid-Could.

That will hit demand for trucking from mid-Could, resulting in empty cabinets and layoffs in trucking and retail business, inflicting what Sløk dubs “The Voluntary Commerce Reset Recession”.

Sløk warned on Friday:

In Could, we are going to start to see vital layoffs in trucking, logistics, and retail — notably in small companies corresponding to your unbiased toy retailer, your unbiased ironmongery shop, and your unbiased males’s clothes retailer.

With 9 million folks working in trucking-related jobs and 16 million folks working within the retail sector, the draw back dangers to the economic system are vital.

There are indicators right this moment that this commerce slowdown is underway, as a result of 145% tariff imposed on Chinese language imports to the US.

The Monetary Instances reviews this morning that the Port of Los Angeles, the principle route of entry for items from China, expects scheduled arrivals within the week beginning 4 Could to be a 3rd decrease than a 12 months earlier than.

The brand new larger tariffs introduced on different international locations are at the moment paused, after all, whereas the US negotiates new commerce offers.

Trump has claimed to Time Journal that he’s made 200 offers. However this seems to be, nicely, an exaggeration.

US Treasury secretary Scott Bessent instructed ABC Information he believes Trump is “referring to sub offers throughout the negotiations we’re doing.”

Bessent insisted, although, that progress is being made, arguing:

If there are 180 international locations, there are 18 necessary buying and selling companions, let’s put China to the facet, as a result of that’s a particular negotiation, there’s 17 necessary buying and selling companions, and we’ve got a course of in place, over the following 90 days, to barter with them. A few of these are shifting alongside very nicely, particularly with the Asian international locations.

Treasury Secretary Scott Bessent defended President Donald Trump’s negotiating technique on commerce offers however mentioned he did not know whether or not Trump was talking instantly with Chinese language President Xi Jinping. https://t.co/kOqQ2STvOf

— ABC Information (@ABC) April 27, 2025

Final week, delivery large Hapag-Lloyd reported that its clients have cancelled 30% of shipments to america from China….and there was a “large enhance” in demand for consignments from Thailand, Cambodia and Vietnam as an alternative.

The agenda

-

11am BST: CBI’s distributive trades survey of UK retailing

-

11am BST: France’s unemployment knowledge for March

-

3.30pm BST: Dallas Fed manufacturing index for April

Key occasions

FTSE 100 on monitor for eleventh rise in a row

Britain’s inventory market is on monitor to match its longest run of good points in eight years.

The FTSE 100 index has risen by 20 factors, or 0.25%, in early buying and selling to 8436 factors. That places the blue-chip shares index on monitor for its eleventh day by day rise in a row, a document final set in December 2019 after Boris Johnson’s election win.

The FTSE 100 final set an extended successful run from late-December 2016 to mid-January 2017, when it rose for 14 days on the trot.

The restoration over the previous few weeks has been helped by the US pausing lots of its tariffs on buying and selling companions (tho not China)

These current good points haven’t totally recovered the losses after Donald Trump’s announcement of latest international tariffs, although, as this chart exhibits:

For April as a complete, the FTSE 100 remains to be down 1.7%.

M&S shares drop once more as cyber disruption continues

Marks & Spencer are main the FTSE 100 fallers this morning, because it reels from the harm brought on by a cyber assault.

Shares in M&S are down 2.3% this morning at 376p, as merchants digest the continuing disruption on the firm.

On Friday it halted all orders by means of its web site and apps, and inspired clients to go to its shops as an alternative.

The cyber incident started every week in the past, on Easter Monday, affecting contactless funds and click-and-collect orders in shops throughout the UK. M&S disclosed it on Tuesday, saying a “cyber incident” affected contactless funds and the decide up of on-line orders in its shops in current days.

Shares in M&S have dropped by over 8% since then, having closed at 411p earlier than Easter.

Susannah Streeter, head of cash and markets at Hargreaves Lansdown, says the continuing issues underline how tough the breach has been to get a deal with on.

Streeter factors out that the suspension of on-line orders will likely be vastly damaging for gross sales, including:

Marks and Spencer’s current run of success has been partly all the way down to the way it been so environment friendly at managing its multi-channel operations with click on and acquire providers notably in style.

It’s been decreasing its retailer footprint specializing in smaller meals shops the place clients can swing purchase and decide up merchandise purchased on-line. This ease of procuring and supply has been upended. Regardless that shops are open, many merely don’t inventory the favored ranges from on-line.

Vogue gross sales are more likely to take an enormous hit notably because the assault has come in the course of the spell of heat climate when summer season ranges would ordinarily be piling up in digital baskets. Whereas different retailers haven’t been resistant to IT breaches, the depth of Marks and Spencer’s issues in resolving the problem are worrying, and it might take a while to win again some extra warier consumers.

Deliveroo shares bounce 17% after DoorDash takeover strategy

Shares in meals supply group Deliveroo have jumped by 17% firstly of buying and selling in London, after receiving a takeover strategy from US rival DoorDash.

On Friday evening, the information broke that DoorDash had supplied to purchase Deliveroo for $3.6bn (£2.7bn).

Deliveroo mentioned that obtained an indicative proposal from DoorDash for a doable money supply value 180p per share, and that it could be “minded to suggest such a proposal to Deliveroo shareholders”.

Its shares have jumped to 170p this morning….

This morning, Deliveroo additionally introduced that it has suspended its £100m share buyback programme, as a result of strategy from DoorDash.

DoorDash’s curiosity comes 4 years after Deliveroo floated on the London inventory market, in what has been referred to as the Metropolis’s worst IPO ever.

Deliveroo’s shares have been priced at 390p every, however slumped by 1 / 4 on the primary day of buying and selling – inflicting the agency to be dubbed “Flopperoo”.

The Instances factors out right this moment that if the DoorDash deal goes by means of at 180p, Deliveroo founder Will Shu would obtain a payout of greater than £172m, primarily based upon his 5.9% stake

UK progress forecast to sluggish sharply as Trump tariffs hit economic system

Mark Sweney

The UK economic system is about to sluggish sharply for the following two years as Donald Trump’s international tariff battle weighs on shopper spending and enterprise funding, a research by a number one forecaster has predicted.

The EY Merchandise Membership is now forecasting that UK gross home product (GDP) will develop by 0.8% this 12 months, down from a projection of 1% in February, and has lower its 2026 forecast from 1.6% to 0.9% as longer-term results hit the UK.

Bloomberg: Shein hikes US costs by as much as 377%

American clients of fast-fashion large Shein at the moment are feeling the affect of the commerce battle.

Shein raised the US costs of a swathe of merchandise on Friday, Bloomberg reported, in anticipation of latest tariffs on small parcels.

Over to Bloomberg for the main points:

The typical worth for the highest 100 merchandise within the health and beauty class elevated by 51% from Thursday, with a number of of the objects greater than doubling in worth.

For house and kitchen merchandise and toys, the common bounce was greater than 30%, led by a large 377% enhance within the worth of a 10-piece set of kitchen towels. For girls’s clothes the rise was 8%.

This follows Donald Trump’s choice to finish the “de minimis” exemption for small packages from mainland China and Hong Kong. which had meant that packages below $800 didn’t qualify for any taxes or tariffs.

China assured of reaching 2025 progress goal, says state planner

China’s policymakers are insisting right this moment that they’ll hit this 12 months’s progress targets, regardless of the affect of Donald Trump’s tariffs.

The vice head of China’s state planner mentioned on Monday he was “totally assured” that the world’s second-largest economic system would obtain its financial progress goal of round 5% for 2025.

Zhao Chenxin, vice chair of the Nationwide Improvement and Reform Fee, instructed a press convention that new insurance policies will likely be rolled out over the second quarter, primarily based on modifications within the financial state of affairs.

Zhao mentioned:

“The achievements of the primary quarter have laid a stable basis for the financial growth of the entire 12 months.

Regardless of how the worldwide state of affairs modifications, we are going to anchor our growth targets, preserve strategic focus and focus on doing our personal factor.”

Introduction: US commerce with China weakening

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world economic system.

Donald Trump’s commerce battle is weakening the US economic system and inflicting a plunge in commerce with China, economists and logistics corporations are warning.

Almost 4 week’s after Trump’s ‘Liberation Day’ announcement of upper tariffs triggered a commerce battle with Beijing, proof is mounting that companies and shoppers are reducing again.

Torsten Sløk, chief government at asset supervisor Apollo International Administration, explains:

For corporations, new orders are falling, capex plans are declining, inventories have been rising earlier than tariffs took impact, and corporations are revising down earnings expectations.

For households, shopper confidence is at record-low ranges, shoppers have been front-loading purchases earlier than tariffs started, and tourism is slowing, specifically worldwide journey.

Sløk has pulled collectively a chartbook highlighting the harm to firm earnings…

…on new orders…

…and notably on commerce with China.

A commerce battle is a “stagflation shock”, Sløk fears.

He explains that it usually takes between 20 and 40 days for a sea container to journey from China to the US. That implies that the slowdown in container departures from China to the US which began in early April will likely be felt at US ports in early and mid-Could.

That will hit demand for trucking from mid-Could, resulting in empty cabinets and layoffs in trucking and retail business, inflicting what Sløk dubs “The Voluntary Commerce Reset Recession”.

Sløk warned on Friday:

In Could, we are going to start to see vital layoffs in trucking, logistics, and retail — notably in small companies corresponding to your unbiased toy retailer, your unbiased ironmongery shop, and your unbiased males’s clothes retailer.

With 9 million folks working in trucking-related jobs and 16 million folks working within the retail sector, the draw back dangers to the economic system are vital.

There are indicators right this moment that this commerce slowdown is underway, as a result of 145% tariff imposed on Chinese language imports to the US.

The Monetary Instances reviews this morning that the Port of Los Angeles, the principle route of entry for items from China, expects scheduled arrivals within the week beginning 4 Could to be a 3rd decrease than a 12 months earlier than.

The brand new larger tariffs introduced on different international locations are at the moment paused, after all, whereas the US negotiates new commerce offers.

Trump has claimed to Time Journal that he’s made 200 offers. However this seems to be, nicely, an exaggeration.

US Treasury secretary Scott Bessent instructed ABC Information he believes Trump is “referring to sub offers throughout the negotiations we’re doing.”

Bessent insisted, although, that progress is being made, arguing:

If there are 180 international locations, there are 18 necessary buying and selling companions, let’s put China to the facet, as a result of that’s a particular negotiation, there’s 17 necessary buying and selling companions, and we’ve got a course of in place, over the following 90 days, to barter with them. A few of these are shifting alongside very nicely, particularly with the Asian international locations.

Treasury Secretary Scott Bessent defended President Donald Trump’s negotiating technique on commerce offers however mentioned he did not know whether or not Trump was talking instantly with Chinese language President Xi Jinping. https://t.co/kOqQ2STvOf

— ABC Information (@ABC) April 27, 2025

Final week, delivery large Hapag-Lloyd reported that its clients have cancelled 30% of shipments to america from China….and there was a “large enhance” in demand for consignments from Thailand, Cambodia and Vietnam as an alternative.

The agenda

-

11am BST: CBI’s distributive trades survey of UK retailing

-

11am BST: France’s unemployment knowledge for March

-

3.30pm BST: Dallas Fed manufacturing index for April

![[Windows 11 Pro]HP 15 15.6″ FHD Business Laptop Computer, Quad Core Intel i5-1135G7 (Beats i7-1065G7), 16GB RAM, 512GB PCIe SSD, Numeric Keypad, Wi-Fi 6, Bluetooth 4.2, Type-C, Webcam, HDMI, w/Battery](https://m.media-amazon.com/images/I/71LYTzK2A8L._AC_SL1500_.jpg)

![[UPDATED 2.0] Phone mount and holder compatible with Samsung Z Fold 2 3 4 5 6 Pixel Fold or Foldable phone | bicycle, treadmill, handlebar, elliptical, stroller, rail, handle, roundbar, golf cart](https://m.media-amazon.com/images/I/51CjGlidGRL._SL1023_.jpg)